Wow, I looked back at some of my posts from earlier this year. Kind of frightening how its playing out.

Whats odd is that its going how I thought it would - I still dont feel any better - actually I feel worse.

So to recap, I said (about the price of oil):

$50 by april

$60 by August

$70 by end of 2009

Well we already made $72/bbl and its still June. So directionally I was right but its beating even my expectations. I probably should have invested some money and set $60 as my selling point. I could have doubled my money!

But to put some meat on the bones I explained to make that future happen we would need to see the following:

Unemplyment peaking, housing inventory falling, some inflation and dollar weakening.

Frightening. So New unemployment numbers are out today and beat analysts expectations - new claims are down again (for what the 5th weak in a row?) continuing claims are still rising but not as fast. So depending on the measure you could argue we are peaking. Housing info is turning positive, new builds are still slow but thats helping to reduce inventory. Prices still falling a bit but not nearly as fast - I think we are seeing it bottom out. Inflation and dollar weakening - check!

My garden is working out OK, the tiller did its job, the seedlings I started in the Bonus room went in the ground in late April. The peppers blanched a little the first week in the bright sunlight but now they are growing nicely. Onions - some have grown well, others seem to have failed. Not sure why? 3 blueberry bushes are growing well but the birds are eating this years fruit. I guess thats ok, I need the bushes to grow and wasnt counting on fruit this year anyway. Ill get a cage for them next year. Finally we have a family or two of squirrels, some chipmunks, birds eating the acorns, and I saw a rabbit this morning - im glad because I was tired of falling on my acorns. I got wild strawberries and blackberries too although I didnt realize I had strawberries until I had mowed them once so their fruit was small.

And now we have ourselves a golf cart. I was thinking of selling my motorbike, but that was before oil went from $50 to $70 in a few weeks. Now Im thinking I might need it again.

Change is coming. In spades. I think this economic "recovery" I spoke of may never truly come.

Thursday, May 28, 2009

So during March and April I was beginning to think that my "turning point" post might have been premature. Perhaps it was - as we saw some continued inventory build. But since May came along we have seen 3 weeks of falling inventory in a row. And since April weve also seen the equities markets make something of a rally. Ben Bernanke has been talking about "green shoots" and signs of a recovery, Unemployement data is showing that new claims are falling, housing is SLOWLY making a come-back.

And when we look at the demand picture we see that gasoline is about even with this time last year, Jet fuel and distillate demand is off about 9% (and accounts for a little less than half the consumption in the US) So overall oil demand is off about 4 to 5%.

I think we are seeing that supply has come down by about 4 or 5%, and Global demand hasnt fallen in all places (like China) so the global picture may continue to tighten this year - we should expect US inventory to fall a little more.

Some wonder if all the stored oil (stored due to the massive market contango that we saw months ago) starts to unwind we might see some prices come down, but I cant help thinking that that the stored oil was already "priced in" to the market when we were at $50. So as those storage tankers drop their cargo we will simply see global inventory fall which will support prices (this assumes people are counting tankers as they should be)

So the big questions still hang on OPEC policy.

What price will OPEC open the taps at? They claim to want $75/bbl but I cant help wonder if they will let it go way past that - they went well past their targets last time. And additionally how long will it take to get there? If it takes more than about a year we might lose enough capacity in OECD and non opec countries due to depletion that the OPEC taps will lose their market influencing power.

I still think its possible to see $80/bbl this year so we might see what OPEC has in store, but I suppose it really all depends on the "recovery". There are still plenty of worrying signs that the recovery wont happen this year at all. 1 in 8 homes in the US are behind on payments or in foreclosure. Thats a staggering statistic this late in the crisis. youd think by now that most of the trouble would be behind us and that those who remain in their home would be more up to date than that. 1 in 8 tells me there may be a lot of bad news yet to come.

And when we look at the demand picture we see that gasoline is about even with this time last year, Jet fuel and distillate demand is off about 9% (and accounts for a little less than half the consumption in the US) So overall oil demand is off about 4 to 5%.

I think we are seeing that supply has come down by about 4 or 5%, and Global demand hasnt fallen in all places (like China) so the global picture may continue to tighten this year - we should expect US inventory to fall a little more.

Some wonder if all the stored oil (stored due to the massive market contango that we saw months ago) starts to unwind we might see some prices come down, but I cant help thinking that that the stored oil was already "priced in" to the market when we were at $50. So as those storage tankers drop their cargo we will simply see global inventory fall which will support prices (this assumes people are counting tankers as they should be)

So the big questions still hang on OPEC policy.

What price will OPEC open the taps at? They claim to want $75/bbl but I cant help wonder if they will let it go way past that - they went well past their targets last time. And additionally how long will it take to get there? If it takes more than about a year we might lose enough capacity in OECD and non opec countries due to depletion that the OPEC taps will lose their market influencing power.

I still think its possible to see $80/bbl this year so we might see what OPEC has in store, but I suppose it really all depends on the "recovery". There are still plenty of worrying signs that the recovery wont happen this year at all. 1 in 8 homes in the US are behind on payments or in foreclosure. Thats a staggering statistic this late in the crisis. youd think by now that most of the trouble would be behind us and that those who remain in their home would be more up to date than that. 1 in 8 tells me there may be a lot of bad news yet to come.

Thursday, February 19, 2009

A turning point?

Well for a while I thought my predictions for oil price may have been bullish.

Today I wonder may be the start of an important turnaround.

For the last few months Ive watched the US oil inventory numbers and seen the inventory buildup. Last few weeks though have shown increased gasoline consumption Vs this period last year. That's interesting and perhaps it shows how the cheap gas - even with our sour economy is too tempting for the average American to resist. This time last year the prices were in the $3 range - now were paying $1.75 or so.

So now inventory fell for the first time this year (the first time since about august of last year?) Imports were down (maybe the OPEC production cuts starting to bite?)

I didn't pare the figures down to see which regions were down or where the imports came from (or didn't come from) but I wonder if this is the start of a new trend. Global demand is indeed falling - but perhaps very slowly. Maybe global production is catching up and overtaking.

Anyway I made a chart for the oildrum that seems overdue. I should have thought of this a long time ago.

Its the relationship between supply and demand and explains the volatility in prices.

The trick with this chart is to take each curve by itself. The supply curve for example is well known and can be plotted with available data - Ill try to dig it up. I approximated it for our purposes.

the demand curve is much more difficult to resolve because its dependant on other factors - the main one being the availability of alternatives.

Demand is realtivley unchanged when the fuel is cheap. Even if you give the fuel away for free there is little more demand than just "cheap" fuel. Once the price starts to rise to levels seen in 2008 we find some demand destruction of a few percent. Demand will fall in the following ways

1) people drive less (combine trips, a little carpooling here and there)

2) next purchase is more efficient

3) next home purchase or job change is made with reduced commuting distance

All those things have a slow effect, but persist with time as people gradually adapt.

When things get really expensive though people start looking for wholesale alternatives. this is how we got through the last oil crunch. We quit using oil to make electricity. By switching to only coal and natural gas we were able to continue growing for another 30 years.

Its possible that wholesale shift could occur for passenger cars. Gasoline makes up more than half the total demand for oil. Heating oil, diesel AND jet fuel combined dont even account for half of the oil used.

for this to occur we need an alternative. EVs (lithium batteries?) plug in hybrids, natural gas powered cars, or some combination of those.

With a viable alternative a price ceiling could be reached. The demand curve therefore shows to basic points:

1) The demand if the product is given away for free

2) the price at which demand goes to zero (price ceiling)

The whole curve can of course move to the left or right depending on the overall size of the global economy.

Where the supply curve and the demand curve cross - thats the "correct" price for the commodity.

Fun huh?

Thursday, January 22, 2009

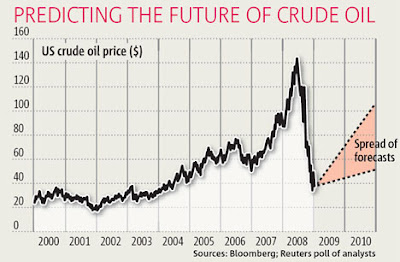

OK, well I dont have a whole lot to add to my predictions but I ran across this graph which I guess puts me in the category of "Oil Bull" compared to all the other analysts polled.

Im hoping to post more about my attempts to create a vegetable garden - one that we can use.

My plan is to grow at least the following:

Onions

Potatos

Bell peppers

Carrots

Those are the most frequently used fresh vegetables in our house and the easiest to grow (compared to beans/peas etc... which require frames/vines)

My first posts on the subject will likley focus on all the fun I had getting the tiller to work.

Saturday, January 3, 2009

whats new since I last wrote?

1) The financial crisis is continuing to play out. Demand for EVERYTHING is down, oil, electricity, steel, copper you get the idea. So prices are down, investment is down, exploration down, rig count down etc...

2) No bottom in sight yet. The Dow spent december in the 8000 range and closed above 9000 for the first time in a while today, it may be signalling a bottom but that would be a leading indicator - plenty of other things will unravel before demand would pick up in commodities. Some others are prediciting the big upswing in the next few months, I tend to think we wont see a strong bottom signal until after March or much later. Caterpillar is battening down the hatches big style - Like i have never seen before. Cancelling 2010 bonuses (which actually really hurts the higher level executives) and laying off agency and contract workers. There is also plenty of effort to move engine assembly away from the Unions - imagine that. 2009 will be an interesting year, im sure we havnt seen the last of the layoffs yet.

3) I have become obsessed with making an old 5hp Craftsman Tiller work. A good friend gave it to me. I think he gave it to me - if he wants money for it then I might need to reconsider because this thing is trouble. I think Adam and Eve used it in the Garden of Eden, did I mention that its old? When I picked it up it had a simple fuel leak (looked like the rubber hose was bad) and dry rotted tires. While fixing the fuel leak I managed to break the carburetor (nice work Phil). Luckily a mower shop had a similar carb on their dusty shelves. It wasnt exactly the same though and was full of varnish. Long story short but the carb is on and the engine runs but it runs like crap, I think the idle circuit is plugged because its hard to nail the mixture at idle and high speed running. I turned my attention to the tires and ordered some new tires for it. They arrived yesterday and I managed to get one off and the new one on today. Turns out they need to have their "bead seated" which generally involves using a compressor to pump lots of air into it. I dont have a compressor so I tried an old trick which sometimes works. Spray starting ether into the tire and light it - the woof/bang inflates the tire so quick it seats the beads. Well it only succeeded in burning the hairs off my hand. I guess I will need to use a compressor. All this so I can make the tiller work - till a spot in my garden and plant some vegetables which will likley fail anyway.

4) It turns out that Cleveland likes to eat Sophia's wax crayons. I act mad at him but I dont really mind too much, we have a billion crayons anyway.

So much has changed but there is much to look forward too in 2009, crappy home grown vegetables for example.

But since I made some predictions in 2008 (with varying success) I thought I should take another stab at it in 2009.

To recap:

I said the Cubs would take the world series. Not a terrible call - they made the playoffs and won their division, but somehow the dodgers stomped them in 4 games. Ouch, not even a pennant. OK so I conceed that one - whoda thunk it the Cubs didnt really win the big one? :)

I said Obama would win the election. I think that was moderatley prescient, I dont think he had even won the primarys when I made that call but I had a feeling about him and I was right.

OK so Im 1 for 2 a real nostradamus.

Oil prices were the fun topic last year and I didnt see the big one. I had a feeling at $130 we were close to top and I was right, we made it up through 140 but not for long. While some were calling for 200+ (A number I knew wasnt yet supported by fundamentals) we started to slide back towards 100. I think 100 to 120 was an appropriate price for the first half of 2008 but by the second half the demand was tanking quickly and I didnt see that coming. I guess I wasnt looking in the right places because the recession had already begun in December 2007!

So I give myself half credit for that one. I saw the reversal (Or overshoot) but not the extent.

So here we are in 2009 in the 30 to 50 dollar range until something big happens. Some are calling for $25 due to some nightmarish economy. Others think by April we'll be slowly marching up to 60+ I tend to think the latter.

Im not assuming that by the end of 09 we will be back over $100.

So what am I saying?

Well give or take about $10/bbl heres what i think.

April $50

August $60

December $70

To do this the economy will need to show signs of strength - unemployment will top, home inventory will start to fall. We may even see some inflation and dollar weakness.

1) The financial crisis is continuing to play out. Demand for EVERYTHING is down, oil, electricity, steel, copper you get the idea. So prices are down, investment is down, exploration down, rig count down etc...

2) No bottom in sight yet. The Dow spent december in the 8000 range and closed above 9000 for the first time in a while today, it may be signalling a bottom but that would be a leading indicator - plenty of other things will unravel before demand would pick up in commodities. Some others are prediciting the big upswing in the next few months, I tend to think we wont see a strong bottom signal until after March or much later. Caterpillar is battening down the hatches big style - Like i have never seen before. Cancelling 2010 bonuses (which actually really hurts the higher level executives) and laying off agency and contract workers. There is also plenty of effort to move engine assembly away from the Unions - imagine that. 2009 will be an interesting year, im sure we havnt seen the last of the layoffs yet.

3) I have become obsessed with making an old 5hp Craftsman Tiller work. A good friend gave it to me. I think he gave it to me - if he wants money for it then I might need to reconsider because this thing is trouble. I think Adam and Eve used it in the Garden of Eden, did I mention that its old? When I picked it up it had a simple fuel leak (looked like the rubber hose was bad) and dry rotted tires. While fixing the fuel leak I managed to break the carburetor (nice work Phil). Luckily a mower shop had a similar carb on their dusty shelves. It wasnt exactly the same though and was full of varnish. Long story short but the carb is on and the engine runs but it runs like crap, I think the idle circuit is plugged because its hard to nail the mixture at idle and high speed running. I turned my attention to the tires and ordered some new tires for it. They arrived yesterday and I managed to get one off and the new one on today. Turns out they need to have their "bead seated" which generally involves using a compressor to pump lots of air into it. I dont have a compressor so I tried an old trick which sometimes works. Spray starting ether into the tire and light it - the woof/bang inflates the tire so quick it seats the beads. Well it only succeeded in burning the hairs off my hand. I guess I will need to use a compressor. All this so I can make the tiller work - till a spot in my garden and plant some vegetables which will likley fail anyway.

4) It turns out that Cleveland likes to eat Sophia's wax crayons. I act mad at him but I dont really mind too much, we have a billion crayons anyway.

So much has changed but there is much to look forward too in 2009, crappy home grown vegetables for example.

But since I made some predictions in 2008 (with varying success) I thought I should take another stab at it in 2009.

To recap:

I said the Cubs would take the world series. Not a terrible call - they made the playoffs and won their division, but somehow the dodgers stomped them in 4 games. Ouch, not even a pennant. OK so I conceed that one - whoda thunk it the Cubs didnt really win the big one? :)

I said Obama would win the election. I think that was moderatley prescient, I dont think he had even won the primarys when I made that call but I had a feeling about him and I was right.

OK so Im 1 for 2 a real nostradamus.

Oil prices were the fun topic last year and I didnt see the big one. I had a feeling at $130 we were close to top and I was right, we made it up through 140 but not for long. While some were calling for 200+ (A number I knew wasnt yet supported by fundamentals) we started to slide back towards 100. I think 100 to 120 was an appropriate price for the first half of 2008 but by the second half the demand was tanking quickly and I didnt see that coming. I guess I wasnt looking in the right places because the recession had already begun in December 2007!

So I give myself half credit for that one. I saw the reversal (Or overshoot) but not the extent.

So here we are in 2009 in the 30 to 50 dollar range until something big happens. Some are calling for $25 due to some nightmarish economy. Others think by April we'll be slowly marching up to 60+ I tend to think the latter.

Im not assuming that by the end of 09 we will be back over $100.

So what am I saying?

Well give or take about $10/bbl heres what i think.

April $50

August $60

December $70

To do this the economy will need to show signs of strength - unemployment will top, home inventory will start to fall. We may even see some inflation and dollar weakness.

Subscribe to:

Posts (Atom)